Driven by an enduring passion for radiofrequency ablation, RF Medical mission is to revolutionize medical treatment by exploring its diverse applications, while also embracing complementary technologies like microwave and cryoablation to cater to varying medical needs.

South Korea is currently facing a unique demographic situation. With over 25% of the South Korean population expected to be over the age of 65, the nation is becoming one of the first super-aging societies in the world. However, this issue is not unique to Korea; other economies such as Japan, China, and the US are also grappling with the same challenge. What challenges and opportunities does this demographic situation create for medical companies?

The prevailing demographic landscape poses not just challenges, but rather a plethora of opportunities. As individuals age, their health needs become more complex, creating an expanding market for medical services. Viewing this from the perspective of a medical device company, the healthcare market is poised for sustained growth. Presently, governments worldwide are allocating substantial budgets to the healthcare sector, both in the private and public domains, resulting in an inevitable rise in healthcare costs. This upswing presents a favorable environment for pharmaceutical and medical companies, as well as businesses involved in catering to the needs of seniors.

The prevalence of cancer is on the rise, partly due to the fact that people are living longer. In the past, individuals often succumbed to various ailments by the age of 60, preventing the development of certain diseases like cancer. However, with life expectancy now reaching 70 or 80 years, the likelihood of encountering diseases such as cancer has significantly increased. Consequently, the growing number of individuals in this age bracket represents a substantial pool of potential clients for medical companies.

In essence, the demographic shift towards an aging population not only underscores challenges but also opens up avenues for innovation, growth, and investment in the healthcare sector.

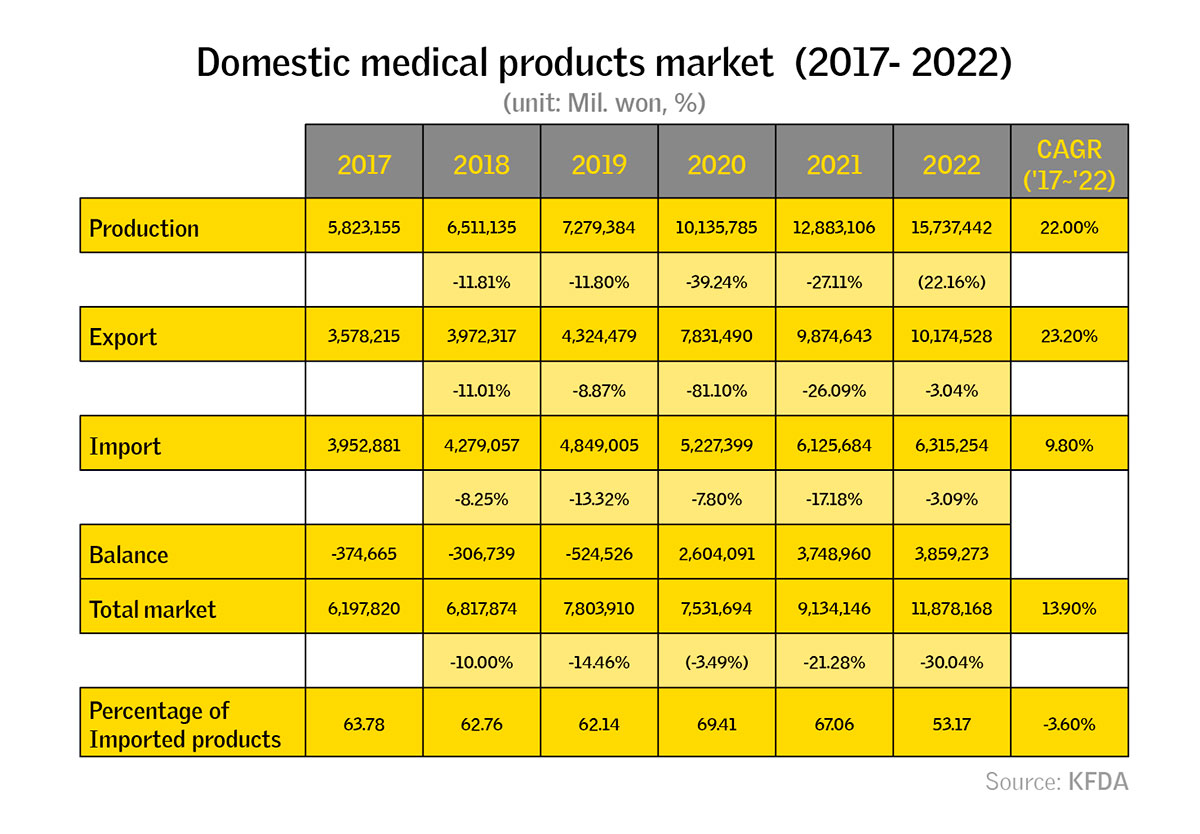

In 2021, the market size of the medical device market in South Korea reached 9.1 trillion KRW. However, critics such as Professor Sun Kyong of Kyung Hee University claim that this increase has mainly contributed to foreign companies, not domestic ones. More recently during a forum at the National Assembly he emphasized that “the domestic medical device market and the domestic market size should grow together.” How do you expect this trend to evolve? How can Korean companies regain domestic market shares?

I believe there may be a misunderstanding on Professor Sun Kyong's part. Allow me to present statistics published by the Korean Food and Drug Administration (KFDA). The overall medical market is expanding, with export volumes on the rise. According to the provided statistics, domestic medical device companies are performing strongly within the market.

To gain a deeper understanding of the statistics and your clarification regarding the professor's misunderstanding, could you elaborate on the factors contributing to Korean companies securing their market share? What has driven this evolving trend?

The dynamics vary across product categories. For high-end products, companies from developed nations hold a significant domestic market share. In contrast, middle-end products show a stronger presence from domestic offerings. Low-end products, on the other hand, tend to be dominated by Chinese alternatives. Notably, amid the COVID-19 situation, South Korea has experienced substantial export growth, particularly in the in vitro diagnostics (IVD) sector. This implies that South Korea is globally recognized for leading technology in the IVD field.

However, in the realm of high-end products such as MRIs, CT scans, angiography, and cardiovascular devices, South Korea faces relatively lower competitiveness. Leveraging its strength in the IT sector, particularly in medical AI, South Korea enjoys a distinct advantage in this domain. Therefore, while challenges exist in certain segments, the nation's prowess in medical AI positions it favorably on the global stage.

We acknowledge the remarkable growth of the Korean medical device industry in the past five years, driven in part by innovation as you emphasized. The advanced IT environment in Korea has facilitated the creation of novel solutions. However, in developed markets, particularly in Japan, the USA, and the EU, medical organizations and practitioners are often perceived as conservative. Overcoming resistance to changing suppliers or adopting new technologies for medical procedures can be a formidable challenge for new products and companies. How are you addressing this barrier, and to what extent can we attribute this challenge to a matter of production reputation versus a matter of technology?

Describing this complex issue succinctly is challenging. Even in developed nations, there is substantial pressure to reduce medical costs, not only for governments but also for medical sectors and hospitals. As we transition into a super-aging society, both private and public sectors have witnessed a surge in medical costs. Correspondingly, healthcare services are on the rise, necessitating concerted efforts to control expenses. This imperative extends beyond government bodies to encompass hospitals and insurance companies.

In this context, the emphasis is on cost reduction rather than the origin of the product, be it Chinese or Korean. If a new treatment emerges with equivalent efficacy to existing options but at a lower cost, the medical sector is inclined to adopt this more cost-effective solution. The focus shifts from the country of origin to the practical benefits and efficiency of the technology or treatment.

In Korea, a discernible trend has emerged: the implementation of new technologies, particularly in the surgical field, often requires training for surgeons to shift their mindset and adopt new procedures. In light of your company's imminent commercialization of new solutions, how do you address these challenges with surgeons?

As a company focused on introducing new treatment methods and devices, rather than merely upgrading existing ones, we leverage various energy sources, including radio frequency, microwave, and cryoablation, to pioneer entirely new remedies for existing or even emerging diseases. Our commitment lies in developing treatments that push the boundaries of conventional approaches.

Given the inherent novelty of our therapies, promoting our products and providing training presents considerable challenges. The primary obstacle is ensuring that medical professionals are aware of these groundbreaking therapies. To address this, we actively engage in clinical trials to publish our therapies and devices in scientific papers. Additionally, we participate in approximately 40 medical congresses annually, both domestically and internationally, to showcase our innovative products and treatment procedures.

Another crucial aspect is training. We organize hands-on workshops, offering sessions that enable doctors to experience and familiarize themselves with our devices. Our treatments often involve methodologies that doctors may not have encountered during their medical education, residency, or internship, making comprehensive training essential.

The U.S. stands as the world's largest market for medical equipment and devices, yet it presents unique hurdles. These include the negotiation leverage of Group Purchasing Organizations, as well as the difficulties in getting certain products, especially those for novel procedures, to get insurance coverage. On an institutional scale, how do you persuade these organizations to adopt your products? Specifically, in addressing challenges in the U.S. market, how have you navigated these issues, particularly in light of your recent FDA clearance?

To be transparent, the U.S. market is intricate, and our understanding may not be exhaustive. We discern two main markets: insured healthcare market and out-of-pocket healthcare market. In the latter case, patients directly bear the cost of treatments that are not covered by insurance. This particularly applies to innovative treatments or procedures that have not yet been widely recognized or reimbursed by insurance providers. As an example, there is the thyroid radiofrequency ablation procedure, which is awaiting a CPT Code from the U.S. government. Despite the unfavorable circumstances, we have successfully implemented this treatment method in many hospitals in the United States, where patients bear the entire cost.

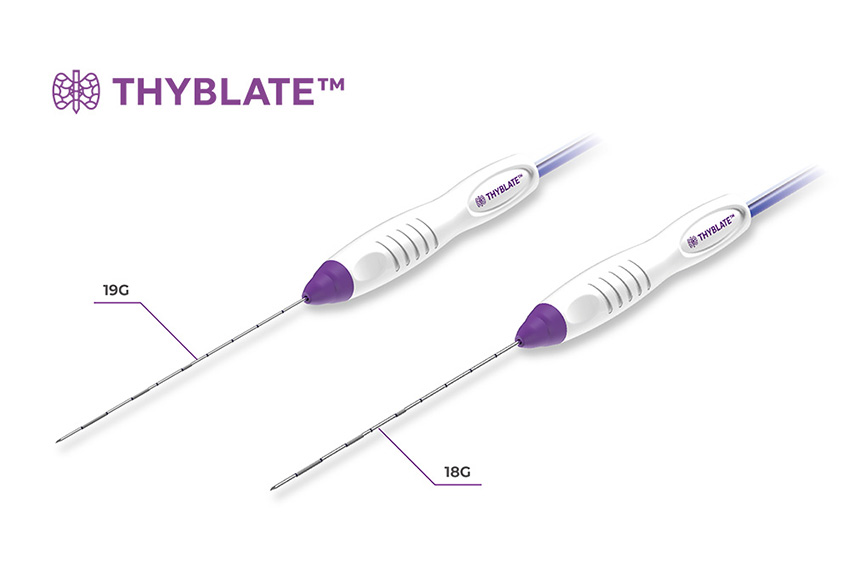

Here is the timeline: We obtained FDA approval for our THYBLATE™ electrode in late 2019 and commenced sales the same year. We anticipate securing the CPT Code around early 2025. Until then, our devices are sold in clinics where patients pay out of pocket without insurance coverage. Despite the absence of insurance, there is demand, particularly from those averse to invasive surgeries. This procedure has found its place in prestigious hospitals such as Johns Hopkins University, Stanford Medical Center, and New York University Hospital.

Consider the example of a thyroid nodule requiring surgical resection, traditionally leaving a noticeable scar and incurring significant costs, around $15,000. In response, we developed a radiofrequency ablation electrode called THYBLATE™, allowing doctors to use a thin needle for nodule ablation under ultrasound guidance. This 10-minute procedure leaves no visible scar, only a temporary mark where the needle was inserted. Importantly, it selectively ablates the nodule without affecting nearby normal tissues. This minimally-invasive approach results in the gradual shrinkage of the nodule over time, offering a compelling alternative to surgery.

Moreover, THYBLATE™ addresses a critical post-treatment concern. Unlike traditional surgical methods necessitating thyroid hormone pills indefinitely due to the complete removal of the thyroid, our radiofrequency ablation system spares the thyroid, eliminating the need for such medication. By selectively targeting the nodule, we can mitigate the risk of hypothyroidism, providing a more patient-friendly and sustainable treatment option.

Innovating Treatment: THYBLATE™ for Minimally Invasive Thyroid Ablation.

Innovating Treatment: THYBLATE™ for Minimally Invasive Thyroid Ablation.

In cases where women are affected by uterine fibroids, invasive hysterectomy surgery is recommended when patients experience excessive menstrual bleeding, pain, and abdominal distension. Consequently, minimally-invasive solutions are available, such as HIFU (High-intensity focused ultrasound), LAP-RFA (RF ablation from outside the body, requiring the use of a camera), and RFA using the MYOBLATE™ electrode, which recently received FDA approval. What are the advantages of MYOBLATE™ compared to other procedures?

Historically, treating uterine fibroids involved highly invasive procedures, such as incisions on the abdomen and the resection of the uterus. This approach is still employed in resource-constrained environments and for those with limited access to advanced medical care. However, in more developed countries, the use of a laparoscope to remove myomas has become a standard practice.

In our MYOBLATE™ product, we employ a comparable approach that involves an ultrasound-guided procedure. Notably, our needle is slightly longer and thicker than regular RF needles, as this ensures better precision when targeting the fibroids. The underlying principle aligns with the trans-vaginal and/or trans-cervical approach, but with variations in size. Doctors leverage ultrasound images to pinpoint uterine fibroids and perform ablation. Crucially, this method allows doctors to preserve the entire uterus, enabling patients to conceive even after undergoing treatment. The procedure leaves no visible scars and minimizes bleeding. With a duration of around 10 minutes, patients can be hospitalized for just one day, receive the treatment, and be discharged on the same day, in stark contrast to surgical procedures, which typically require several days of hospitalization.

Revolutionizing Uterine Fibroid Treatment with MYOBLATE™ Electrode.

Revolutionizing Uterine Fibroid Treatment with MYOBLATE™ Electrode.

With its numerous advantages, including one-day hospitalization, absence of post-surgical complications, and a short treatment time, one might wonder why all hospitals are not adopting this innovative procedure. Could you shed light on the reasons behind this?

There are several factors at play. As mentioned earlier, doctors tend to be conservative, and the adoption of a new and innovative treatment is not an instantaneous process. It requires time. Take, for instance, radiofrequency therapy for thyroid nodules, which was initially developed around 20 years ago. However, it only gained widespread acceptance around 2007 in Korea, a five-year span. In its early days, no one in Korea performed this radiofrequency treatment for benign nodules. Fast forward to the present, and doctors would face significant criticism if they opted for surgical resection for benign nodules. Changing the entrenched mindset and awareness of doctors is a gradual process that demands time.

We are actively working to reshape perceptions and raise awareness. As time progresses, we anticipate a complete transformation in this trend, with a growing preference for minimally invasive procedures. It is a matter of changing ingrained concepts, and we are confident that as awareness spreads, more hospitals will embrace these innovative approaches.

RF Medical’s products encompass a variety of oncology solutions, from common types of cancer (such as liver tumors) to rarer conditions including spinal and vertebral tumors. Interestingly, the market for such devices is mostly controlled by large multinational companies, such as Johnson & Johnson and Medtronic, whose OSTEOCOOL has a dominant market share and reputation in spinal procedures. How do you plan on competing with these large corporate groups, especially in light of their larger brand capital and financial capabilities?

Certainly, the domination of the market by major players is a well-known fact. While we recognize the efficacy and safety of radiofrequency treatment, microwave treatment, and cryoablation treatment, it is imperative to acknowledge that we cannot excel in every sector. Take, for instance, metastatic spine tumors, a common occurrence in patients with lung cancer resulting in significant pain. RF Medical introduced a treatment method for metastatic spine tumors 15 years ago. Despite the excellence of the method and the effectiveness of the treatment, immediate widespread market adoption was not guaranteed.

Our competition takes two forms: one between radiofrequency companies and the other involving different treatment methods. For instance, lung tumors can be treated through radiotherapy or surgical resection. An additional hurdle we have encountered is that radiofrequency treatment is not reimbursed in certain countries, whereas radiotherapy and surgical resection receive reimbursement. Despite our treatment's advantages, including less invasiveness and shorter hospital stays, it faces challenges gaining traction compared to other methods.

Another noteworthy challenge arises in the realm of bone tumors, primarily treated by interventional radiologists (IR). However, patients typically consult with radiotherapists and surgeons, bypassing radiologists who do not get a chance to meet patients face to face. There is a territorial competition between departments, hindering patient referrals between surgeons, radiotherapists, and radiologists within the same hospital. Despite their shared institution, these departments vie for patients independently. Our therapy, predominantly practiced by radiologists, faces limitations in expansion due to this departmental rivalry.

Recognizing such constraint, we adapted our strategy in some countries. We targeted our marketing efforts toward surgeons rather than radiologists, allowing them to maintain their patient base and territorial control without the need for patient transfers between departments. This strategic shift has facilitated a more accessible penetration into the market.

Acquired in 2019 by STIC Investment, RF Medical received 20 billion KRW of investment for new products development and obtaining regulatory certifications. How has this acquisition impacted your operations and your research and development (R&D) efforts as you aim to establish a stronger foothold in the global market?

To be candid, this investment has proven beneficial in certain aspects while presenting challenges in others. The increased financial resources have afforded us greater flexibility, allowing for a more assertive approach in R&D investments. However, it has also subjected us to heightened performance expectations, creating additional pressure on our operations.

Does this acquisition contribute to obtaining more certifications, finding partners, and establishing stronger connections with hospitals?

In certain respects, yes. Receiving substantial investment from a prominent private equity firm signals a promising future with significant potential, making it somewhat easier to garner credibility among doctors. The increased capital enables us to attract more talented professionals, conduct a greater number of clinical trials, and obtain more international certifications. This expansion not only leads to company growth but also enhances our credibility in the eyes of customers. Additionally, the heightened financial capacity allows us to engage in more international medical congresses, amplifying our presence and awareness in the global market.

Discussing the global market, you mentioned securing FDA approval in 2022. Additionally, in 2023, you successfully transitioned from CE MDD to CE MDR, aligning with the latest EU regulations. Could you provide insights into your strategic approach? What key markets have you identified for future growth?

Our focus varies depending on the product category, with an emphasis on markets with substantial size. While Africa has a large patient population, the limited availability of doctors and hospitals, coupled with cost considerations, constrains its market potential. The United States stands out with the largest market size, constituting 43% of the global market share. Despite its significance, penetrating the U.S. market poses challenges due to stringent regulations.

In contrast, the European market offers an open and relatively accessible environment, leading us to actively sell our products there. The Chinese market, although vast, presents rapid and unpredictable growth, coupled with significant trade barriers. Despite registering our products in China for the past four years, the process remains ongoing, highlighting the complexities of this market. Japan, another sizable market, also poses high regulatory barriers. Overcoming such regulatory challenges emerges as a critical hurdle for medical device companies, surpassing technological development concerns.

The regulatory landscape extends beyond Europe and the United States, encompassing countries like China, Japan, and smaller nations such as Taiwan. In the past, overcoming these regulatory hurdles incurred a cost of about $100,000, but the current landscape demands an investment exceeding $500,000. This substantial increase, nearly fivefold, underscores the evolving challenges faced by medical device companies in navigating diverse regulatory systems globally.

What are the reasons for the increase in certification costs?

The increase in certification costs can be attributed to heightened requirements from regulatory authorities. Demonstrating efficacy and safety now necessitates extensive clinical trials and various tests, such as biocompatibility and electromagnetic interference tests. Presently, there are five times more requirements compared to the past, including several deemed unnecessary. Despite the general acknowledgment of our products' safety, official proof of safety through clinical trials is mandatory. In the United States, the implementation of just one clinical trial can cost between 2 million to 3 million dollars.

Which of your products do you anticipate will be the primary driver for growth in your company's overseas markets?

Considering the prevalence of medical conditions, such as thyroid nodules affecting one in ten people and uterine fibroids affecting half of all females, it is important to note that not all individuals require treatment. Approximately one in twenty with thyroid nodules and 5-10% of those with uterine fibroids may necessitate treatment. Similarly, spine-related issues, including low back pain, present diverse causes, each potentially treated with specific therapies, including radiofrequency ablation treatment. Our product portfolio is intricately linked to these conditions, and their applications are disease-specific.

It is crucial to understand that a higher number of patients does not necessarily correlate with a larger market size. Some diseases require treatment while others do not, and certain conditions may have multiple treatment options beyond radiofrequency ablation.

Moreover, the treatment market is dynamic, with trends shifting over time. What may become a widely embraced treatment at one point could surpass expectations in popularity, resulting in increased sales. Conversely, therapies that seem promising might not achieve the anticipated success.

RF Medical's journey began with liver cancer treatment, but as the liver cancer market diminished, we shifted focus to varicose veins, contributing approximately one-third of our revenue. While stable, this market does not boast significant growth. Presently, our primary focus revolves around thyroid and uterine fibroid treatments, featuring products named THYBLATE™ and MYOBLATE™, respectively. Looking ahead, we see potential growth in addressing low back pain.

Year 2023 marks a significant milestone for RF Medical as the company celebrates its 20th anniversary. Looking ahead to the next decade, as we revisit in 10 years, what achievements or aspirations would you like to see realized at RF Medical before your retirement?

Since the beginning of my career, I have been passionate about radiofrequency ablation, and I hold great affection for its potential. Beyond the diseases we have discussed in this interview, there are numerous conditions that can be effectively treated with radiofrequency. Currently, we are in the process of developing multiple treatments. Safety and effectiveness are crucial aspects of any treatment, and I firmly believe that radiofrequency treatment can meet both criteria for a wide range of diseases. Consequently, our focus remains on expanding our efforts to address additional medical conditions. It is important to note that while radiofrequency is a valuable method, other technologies, such as microwave and cryoablation, may be more effective for certain diseases. Therefore, we are committed to developing additional treatment systems tailored to specific medical needs.

Our overarching goal is to equip our customers, the doctors, with a diverse arsenal of treatment options. Analogous to a soldier being better equipped with various weapons, including a gun, rifle, and cannon, our approach involves expanding beyond radiofrequency to include microwave and cryoablation devices. We aim to develop more minimally invasive treatments, and my personal goal is to support our employees in achieving these advancements. While financial success is a goal, my ultimate aspiration is for our clients to provide exceptional treatment to their patients, earning commendations, and ensuring that patients receive safer treatment through our company.

For more details, explore their website at https://www.rfa.co.kr/

0 COMMENTS