By harnessing robust engineering, MCNEX integrates camera, optical, and mechanical modules into systems, enabling intelligence in smartphones, cars, watches, and robots.

The success of Korean conglomerates has had a positive trickle-down effect on domestic suppliers, providing them with growth momentum and core capabilities. However, in recent times, due to an increasingly saturated and competitive domestic landscape, it has become essential for enterprises to think globally to continue their growth trajectories. In order to achieve this goal, Korean companies will need to find their place in the global supply chain. What are the opportunities for Korean suppliers from the ongoing realignment of the supply chain? Can Korean companies become bigger partners to U.S. companies in the future?

Korean SMEs and mid-sized companies have experienced mutual growth through their symbiotic relationship with Korean conglomerates over the last two to three decades. While it's true that Korean SMEs not only focus on the domestic market due to its size but also expand overseas directly or indirectly through their partnerships with conglomerates, it's also true that SMEs and mid-sized companies worldwide, including those in Korea, Japan, Germany, Taiwan, and even China, are engaged in fierce competition. Initially, it was German and Japanese companies, driven by rapid industrialization, that enjoyed exponential growth by securing proprietary technology. However, as patents expire, we're now in a phase where patents are renewed, benefiting Korean and Taiwanese companies. Nevertheless, we face stiff competition from Chinese contenders.

In the mid to long term, Korean SMEs are better positioned than their counterparts in, for example, Taiwan, due to a robust ecosystem led by Korean conglomerates like Hyundai, Samsung, SK, Posco, and LG. Although Japan and Germany also boast numerous conglomerates, Korean conglomerates play a larger role in the global market, providing a window of opportunity for Korean SMEs. In the past, Korean companies lacked reputation in the global market, but today, thanks to the stellar performances of Korean conglomerates, we have ample opportunities to establish ourselves as attractive options for overseas partners.

However, the overall merits I've mentioned are not solely attributable to Korea. Overseas regulations, particularly concerning parts, materials, components, and semiconductors, such as the trade policies you've mentioned, present opportunities for Korean, Taiwanese, and Japanese companies compared to their Chinese competitors. For instance, while Germany specializes mainly in mechanics or proprietary technologies not subject to such regulations, Korea, Japan, and Taiwan primarily operate in parts, materials, and components, areas subject to these regulations. Therefore, acts like the IRA or the Chips Act present opportunities for us while also giving Chinese competitors time to catch up.

The heavy investments or support from the US administration for battery, or new material companies mirror what the Chinese government has done for its own companies over the last two decades. The US administration's actions create opportunities not only for Korea, Japan, and Taiwan but also for their own companies. Whereas the Chinese administration has violated WTO regulations to support its companies through free grants, zero-rate loans, or export incentives, what the US administration is doing now offers tremendous opportunities for all of us. Thus, we must seize this opportunity and contribute to the US administration's efforts.

I believe US policies will be mutually beneficial for Korean, Taiwanese, and Japanese companies as well as the US administration. In the past, the US administration didn't invest much in manufacturing, but now, their focus on sectors like semiconductors, battery, renewable energy, and waste management, which typically have a ten-year cycle, suggests a shift. The upfront investments they're making now will yield long-term benefits through employment, exports, and ultimately, improving their trade balance. Regardless of the outcome of the US Presidential election, these policies can stabilize the increasingly divided political structures worldwide.

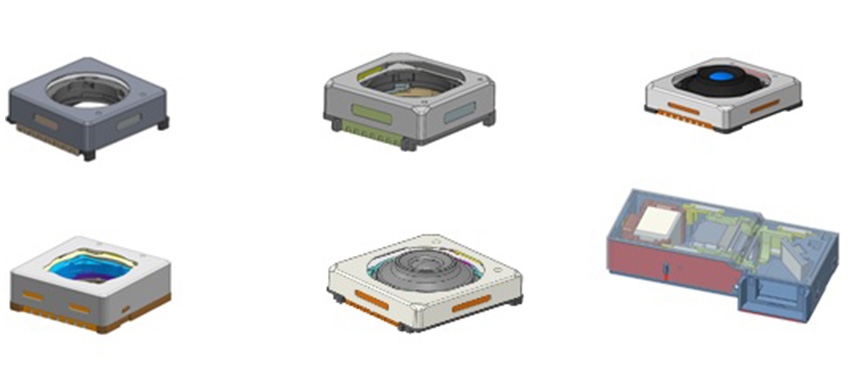

While businesses similar to ours exist in Japan, China, and even Korea, what sets us apart is our specialization in imaging parts not only for smartphones, tablets, or PCs but also for vehicles, security cameras, and wearable devices. We continuously evolve to meet the evolving needs of our customers. However, competition in this sector is intensifying as everyone anticipates its future growth. Our strategy lies in diversifying our portfolios across all sectors, leveraging the convergence and integration of different technologies and products, and providing niche technologies whenever needed. All our product lineups synergize recently.

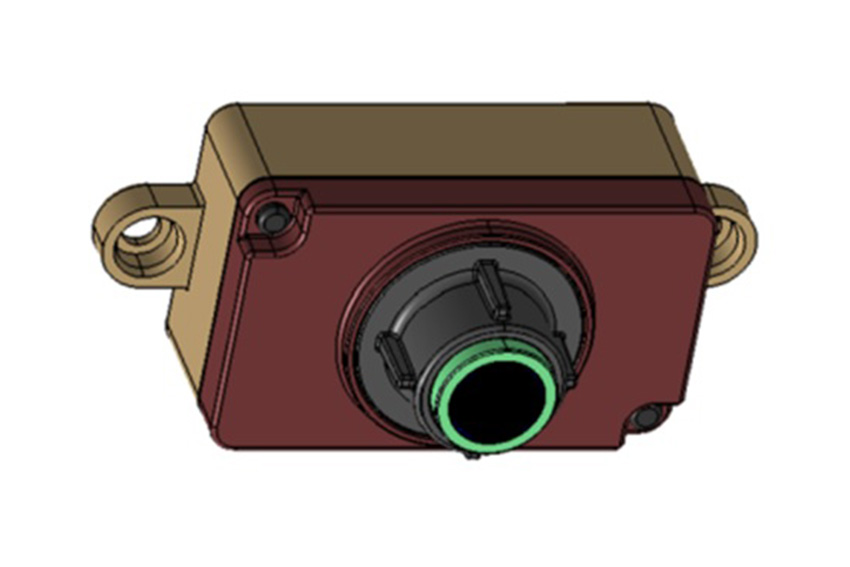

Allow me to share some examples showcasing our capabilities. We've been producing fingerprint biometric sensors for ten years, but four to five years ago, we began focusing on fingerprint sensors for vehicles as well. These sensors can detect whether the driver is dozing off, experiencing pain, or even discern their emotional state. They enable the car to start immediately, open or close doors with biometrics, and even allow the driver to order food from the system. We've also improved payment methods; the car can now pay toll fares through tele-metrics, eliminating the need for the driver to use a high pass. We've provided biometric fingerprint sensors for the Genesis lineups.

Fingerprint sensing system

These days, cameras ceased being just an end product and started becoming enablers of other technologies. Innovation now involves stacking different technologies together. Cameras are omnipresent, found in phones, cars, wearables, and watches. Despite 80% of today's demand coming from the mobile industry, how do you foresee the evolution of demand for camera modules? Which applications do you believe will lead the industry's growth?

It's undeniable that steady demand will come from smartphones or tablet PCs worldwide, with a CAGR of 3 to 5%. Since customers tend to change their smartphones or tablets every two to three years, hardware or battery cycles will need updating every three to five years as well, maintaining regular demand.

While smartphones and tablet PCs will drive stable growth, I anticipate the annual growth rate plateauing at 3 to 5%. Exponential growth will be fueled by individual preferences, such as people opting for VR or AR headsets, or Gen Z and millennials seeking enjoyment through virtual gaming content. Thirteen years ago, smartphones were used by a minority, but as smartphone technologies matured, the penetration rate reached 70 to 80% globally. I expect a similar trajectory for this sector.

Various camera modules for smart phone applications

OIS & Folded zoom actuators

Additionally, our business is closely linked to wearable devices catering to personal well-being, safety, and security. Wearable devices include watches, rings, bands, etc. Across advanced economies, low birth rates are observed. In Korea, it's at 0.7%, and in advanced economies like the US and European countries, just above 1%. Every country faces a demographic cliff. In Asian economies, there used to be high respect for the elderly. Now, the elderly live in more single-person households as fewer parents live with their children. There will be increased demand for wearable devices catering to the well-being and safety of these elderly single-person households.

Furthermore, from an industrial perspective, we have high expectations for driverless vehicles. I believe autonomous vehicles are the future. Currently, we're commercializing 2.5-level autonomous vehicles. Level three vehicles, though rolled out by Tesla, are rather unstable. I anticipate a longer timeframe for level three adoption, as indicated by industry experts. Investments into autonomous vehicles won't cease, but rather be put on hold and adjusted. I foresee levels three to four driverless vehicles merging within the next three to four years, although delays are possible. This shift is crucial due to the aging population. In countries like Korea, Singapore, and Japan, the number of senior drivers over 80 has increased, resulting in more accidents. Autonomous vehicles can address this issue and allow people to acquire driver's licenses earlier, increasing the economic population. Moreover, by automating logistics and mundane tasks, we can alleviate the demand for skilled workers.

Automotive camera modules for ADAS & Autonomous Driving application

Although some critics argue that developing driverless vehicles takes longer than launching satellites into space, I believe it's the way forward. Achieving level five driverless vehicles isn't just about company profits; it's about the overall well-being of humanity.

Mature driverless vehicle functions can significantly reduce social costs by improving infrastructure efficiency, addressing traffic congestion, and eliminating toll booth personnel. Car-to-car communication, enabled by high security, can facilitate low-speed payments. Moreover, driverless vehicles can revolutionize logistics, ensuring deliveries occur when roads are least congested, enhancing efficiency.

However, from a business perspective, there's a gap between technology development and tangible benefits, typically three to five years. Hence, we must consider how to profit from current technologies. Immature technologies like level three autonomous vehicles, while unstable now, could cause global havoc if not fully developed. We aim to achieve levels 3.5 or 4. Automakers worldwide are pondering how to differentiate themselves from competitors. For instance, Hyundai integrates level 2.5 or 3 driverless functions into its premium lineups like Genesis or K9, rather than Sonata or Avante, which are lower-tier cars. These days, automakers are applying level 2.5 functions even to lower-tier cars for mass adoption. As the market expands, so does cost competition, but thankfully, quantity and revenue also grow. We're implementing a two-track strategy: focusing on level 2.0-2.5 cars currently while planning for future businesses in the mid to long term.

Could you elaborate further on how crucial the convergence of different modules and technologies is to develop solutions tailored for levels 3-3.5, and ultimately, if we aim for level 5, how pivotal are they as stepping stones?

The technological convergence and integration you mentioned are paramount in this field. For instance, Mobileye and Tesla, pioneers in launching the autopilot system, demonstrated the feasibility of selling software devices within vehicles. I believe we have significant potential in enhancing drivers' convenience through software integration and convergence in cars. However, if we reflect on the landscape five years ago, numerous autonomous vehicle startups emerged, showcasing robust technologies in the US, EU, Korea, Israel, Germany, and even China. Yet, today, fewer than 10% of them remain viable. This is largely due to the substantial R&D costs involved. For us, it was crucial to tread cautiously, balancing R&D costs with manufacturing costs, as an imbalance could lead to unfavorable outcomes.

Looking ahead, what innovations and diversifications can we anticipate from MCNEX over the next three years?

Our primary focus will remain on the smartphone and tablet PC market due to its substantial size. However, our new ventures will encompass wearable devices catering to healthcare, VR/AR devices, and autonomous vehicle sensors for levels 3-4 autonomous driving. Additionally, our secondary markets, benefiting from these three sectors, include robotics, humanoid technology, UAM (Urban Air Mobility), drones including military purpose drones, and even heavy-duty agricultural vehicles like hydraulic bulldozers.

MCNEX Headquarter

Regarding potential technological advancements, I believe optic mechanical design holds promise. We possess the capability to design and manufacture hardware components and interfaces tailored to our customers' needs. Furthermore, we're committed to enhancing our software capabilities because the integration of optics, mechanics, and hardware demands specialized software. Strengthening our R&D capabilities, particularly in software, is crucial to ensure our customers fully understand and can utilize our technology effectively.

From my 20 years' experience as an entrepreneur, I emphasize the importance of technological prowess, manufacturing competitiveness and effective marketing strategies. Understanding how to sell and whom to sell to is paramount. For businesses, attaining the cost competitiveness currently seen in China is the key to long-term survival. Additionally, the high costs associated with the US market are largely driven by the export ban against China. Our manufacturing competitiveness lies in our manufacturing facilities in Vietnam, which offer cost advantages compared to China. With a capacity of 300 million units per year and various tax benefits, including EP company status and FTAs with Vietnam, our Vietnamese plants position us competitively in the global market.

MCNEX Vietnam factory

Research and development (R&D), manufacturing capabilities, and post-benefits are all crucial aspects of our operations at MCNEX. Currently, MCNEX is performing well, but we are constantly looking towards the future and how we can sustain growth. One option under consideration is establishing manufacturing sites in India, Mexico, or the US. However, our focus is not solely on manufacturing; we are also considering R&D and sales strategies tailored to each market.

Setting up a manufacturing plant in India presents unique advantages. India's strategic location, proficiency in English, and the presence of credit card A/S centers make it an attractive option. Additionally, with its vast population surpassing China's, India offers a substantial market for our products. Exporting logistics and manufacturing to India could also serve as a bridge to connect us to the African market.

Prime Minister Modi's re-election further enhances India's appeal for business investments. Modi's efforts to emulate successful Chinese business strategies, particularly in becoming a global manufacturing hub and imposing import taxes to attract manufacturing, indicate a favorable business environment.

Moreover, India stands to benefit from recent trade policy changes by the US administration. With the complex relationship between China and the US prompting more US allies to shift manufacturing operations to India, the Indian market presents significant growth opportunities.

While our business primarily revolves around manufacturing technology, sales, and marketing activities, recent global political turbulence underscores the importance of considering the overall business landscape and international cooperation. As part of our efforts, we are actively exploring opportunities in the Indian market. Another effort is focusing on the U.S. market. While our current orders from the US are limited, we are observing increased efforts by the US government to incentivize manufacturing on home soil. Consequently, we are exploring the establishment of manufacturing facilities in the US to stabilize our operations and contribute to improving the US trade balance, which has faced deficits in recent years. Looking ahead, we anticipate continuing direct sales into the US market in the medium to long term. While our previous business strategy focused primarily on differentiated technologies and marketing activities, the current political climate has emphasized the significance of navigating geopolitical factors. Therefore, we are adopting a more holistic approach that considers political dynamics alongside our core business strategies.

As an SME, we face challenges in managing our business due to limited capital and manpower compared to conglomerates. However, our focus on robust performance over the next three years positions us to attract investments and sustain growth. While the autonomous vehicle industry saw significant investments five to ten years ago, only a fraction of businesses has remained viable. By continuing to perform strongly, we are confident in our ability to attract further investments and navigate the challenges ahead.

For more details, explore their website at https://www.mcnex.com/en

0 COMMENTS