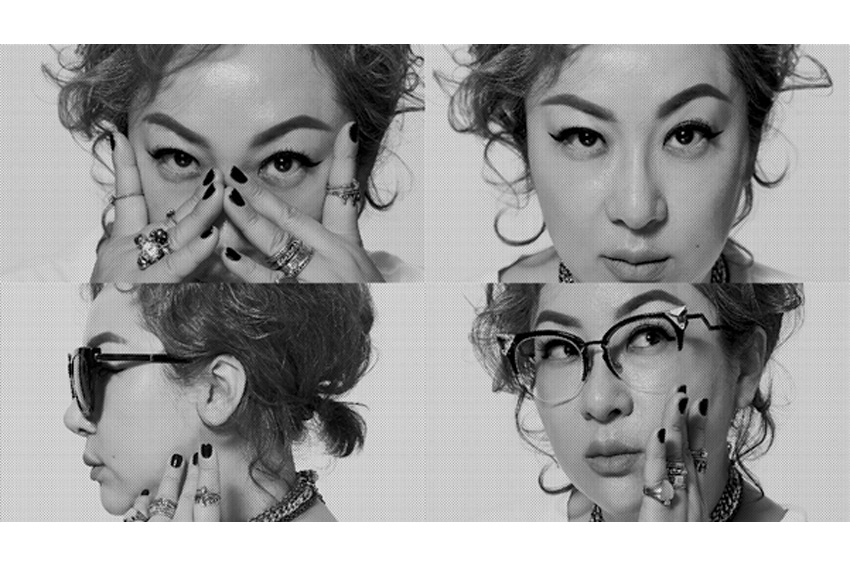

Delve into the extraordinary narrative behind the CHOSUNGAH BEAUTY’s evolution, driven by a dream to create a world where every individual finds joy and fulfillment in their unique beauty journey.

The first question for you as a makeup artist and the CEO of a leading Korean brand, In the past decade, we've witnessed the Korean cosmetics industry experience a significant boom. Exports have surged exponentially, positioning Korea as the world's leading exporter of cosmetics. This growth is largely due to the creation of numerous innovative products catered to skincare routines and color makeup. Additionally, we've seen the rise of many unique indie brands in Korea. From your perspective, what are the strengths and weaknesses of the Korean cosmetics industry? Also, how do you perceive the competition from other countries, particularly Japanese and French brands?

The rise of K-beauty can be attributed to the passionate female customers who have a fervor for beauty. As a makeup artist since 1989, I have interacted with over 10,000 Korean women, including models, celebrities, and actresses. One characteristic of Korean women that stands out is their impatience. They crave immediate results when it comes to beauty, and if a product doesn't show noticeable improvement within a couple of weeks, they tend to not trust the product.

This yearning for instant results has driven Korean women to be incredibly trend-sensitive. They quickly adapt to new trends, which often leads to a high turnover of products. While this might seem like a lack of brand loyalty, it has, in fact, pushed brands to be innovative and responsive. This rapid product development cycle, often completed in just four months, has been shaped by over a decade of catering to these trend-sensitive consumers.

The speed of production might seem disadvantageous considering the demanding nature of Korean women, but it's a significant advantage. The discerning nature of these women provides an invaluable critique of what works and what doesn't, allowing us to create high-quality, stable products swiftly.

Now, regarding the weaknesses you mentioned earlier, I see them as opportunities, especially in the wake of the pandemic. With the rise in online shopping, there's a window of opportunity for smaller brands like ours to penetrate the market. The younger generations, particularly those belonging to MG and Gen Z, are what we call "phono sapiens." They were born into a world of smartphones, and they search and communicate everything through this device. They prioritize value over luxury, and their consumption habits have become smart.

By focusing on these younger generations and online platforms, we can turn these challenges into opportunities. Large companies may have established their positions with robust marketing strategies, but their size often slows down their product development cycle compared to smaller ones. We, on the other hand, are able to quickly reflect real-time trends, predict future needs, and develop products within four months.

This fast-paced approach isn't just about selling products; it's about consistently releasing relevant content on the platforms where our target audience resides. We combine product planning with content creation to tell a cohesive story. For instance, when a makeup tutorial and a product are released simultaneously while reflecting the trend in real time at a speed that larger companies can't match.

The power of content has been evident in the rise of K-pop culture, mukbang, and other aspects of Korean lifestyle. This, combined with our speed and flexibility, allows us to overcome barriers that big companies can't.

Targeting MG or Gen Z with solid, stable products based on a strong brand identity and rich content can give smaller brands a competitive edge. These younger generations form a fandom around influencers who represent the brands, creating a strong customer base.

Our strategy has been tested and proven in the smart digital cultures of Korea, China, South East Asia, and I believe it will soon spread to the US and other regions. With our own long-standing experience in content creation and communication, we have created a foundational source that can be localized by influencers in each country. Ultimately, I see this as a content business.

About 20 years ago, I was the first makeup artist to appear on home shopping. Back then, the idea of buying cosmetics through television seemed ludicrous. But when the products sold out in just 20 minutes, it became clear that we weren't just selling cosmetics; we were selling "how-tos". This experience showed me the power of content and communication, and it's this knowledge that we apply to our brand.

In conclusion, the smart digital culture of Korea and China will inevitably spread to the US and other regions. By targeting MG and Gen Z with a solid brand identity, stable products, and engaging content, smaller brands can successfully penetrate the market. Influencers play a crucial role in this strategy, as they localize the content and represent the brand. Ultimately, I see this as a content business.

This seems to be a significant challenge for a Korean brand. While China and Korea have been rapidly evolving markets for your company, they are quite similar. However, as far as I understand, there are significant cultural barriers when it comes to markets like Japan, the United States, and Europe. These regions don't necessarily share the same mindset, influencers, or design aesthetics. However, with the recent surge in K-pop, we've seen lines blurring and Korean culture spreading worldwide. For instance, well-known K-pop groups even met with Joe Biden last year.

So, my question to you is: Given that you need to tailor your products to each region, how do you anticipate the needs of markets like the United States and Europe? As a beauty brand, this might be a challenging task, but I'm curious to understand how you perceive and cater to the needs of these distinct regions.

If we consider targeting the Phonosapiens, a broad and unspecified group, I believe it's impossible due to the unimaginable costs involved. That's why we're keeping a close eye on the U.S. market. My daughter is part of the Gen Z, a Phonosapien. She shops entirely on Amazon and draws inspiration from various content. Our biggest strength is our ability to endlessly create content. Trends spread incredibly fast through influencers. In the old days, trends were about makeup and clothes for specific seasons, but now, people wear winter clothes in the summer and there's a great diversification in personal style. Fandoms form around these influencers.

Therefore, targeting Gen Z and Millennials, we believe Amazon is the most accessible platform. Our strategy begins with Amazon, where there are reviewers. If you look at marketing as a pyramid, good Amazon reviewers and micro-influencers are at the base, followed by larger influencers, then stars, and finally, celebrity marketing at the top. We start with Amazon. From our research, Amazon holds about 30% of the U.S. market, which is significant.

In the past, our brand was the first Korean brand to enter Sephora, but we failed. We failed in our offline expansion. We went too wide, and managing offline is no joke. Huge costs are involved. Once we start selling our brand on Amazon, which holds about 30% of the U.S. market, and gain recognition, we'll have endless micro-influencers and reviewers. That's how a brand like Chosun Beauty, which we thought nobody knew, became a hit. The branding comes next and is created by the Gen Z. They discover through TikTok and YouTube and purchase through Amazon. We create a perfect triangle structure and target that 30%. After the U.S., we plan to expand offline to Europe. It's really hard to enter a place like Olive Young. But online, there are indicators showing that the brand is trending. If we used to try to go offline first, now we target Gen Z and Millennials and expand the brand and items through the content and influencers they adore. In other words, we expand one item, gain recognition, and then start branding. Then we start expanding offline.

We believe the most effective strategy for Korean brands is the convergence of skincare and color makeup. There are many different races from the start, and we failed initially because we jumped into color shades too fast. It was too big of a picture that we couldn't handle. When the base is applied, it should look noticeably prettier. I did basic care, and I look better right away. This is the sentiment Korean women want the most. We're globalizing that. It's self-explanatory. Gen Z doesn't read text. They communicate everything through videos and images, so we have to completely focus on that and use a strategy to make one item a hero. If one hero item emerges on Amazon, the next steps are not that difficult.

So, we believe the most Korean things are the most competitive, and globalizing Korean things is the most important task. We have found some answers. It's through skincare. Koreans are known for good skin, right? Glowing skin. Naturally, skincare and color makeup are converging. So, we're showing natural results through convergence skincare and color convergence. We have many items that can naturally overcome the difficult color barrier while being Korean. They have been researched and are ready. That's what's brand-like about us.

This is a cream. A volume cream. When you apply this, it improves wrinkles and sagging facial volume. It's obviously a basic skincare product. But if you apply it like this, it's a skincare product. But if you apply it like this, the volume changes already.

So, it has a plate. It's easy to use with the plate, and just wipe after use. The before and after is clear. Regardless of gender, age, or race, it makes your skin look better than your natural skin. L'Oreal and Amore Pacific also present wrinkle volume creams, but Korean women don't like it to end there. They want to see the effects with their eyes. That's why this product is an evolution. It can also whiten.

Given your expansive knowledge of the market, it would be valuable to explore your products and technology further. Earlier, we were introduced to the Lemon Chung Cleanser and other inclusive products aimed at those on a budget. Additionally, your brands 16 and 22 are noteworthy for empowering women by offering them the freedom and convenience to use makeup as they wish, while also ensuring high quality and user-friendly products. I'm eager to learn more about your brands and products. How do you infuse your company identity into these new brands? And how do you incorporate the brand name into these different sub-brands?

There's a rich history behind our brand. In the past, large corporations such as Amore Pacific and LG Household & Health Care dominated nearly 70-80% of the Korean market. However, following the pandemic, lesser-known brands, including ours, began to fill the gap left by these conglomerates. Today, the market share is almost evenly split, with a 50:50 or 60:40 distribution. This shift was primarily due to a significant change in distribution channels. The offline market began to decline, and large brands with an extensive physical presence found their markets shrinking. In contrast, online-focused brands, employing targeted marketing strategies, started to rise, now claiming nearly half of the market.

Initially, our brand portfolio included Chosungah TM, a premium brand that could be compared to a master's work of art. It was the first brand to find success through home shopping under the name Chosungah, and it strongly reflects my personal touch. This brand has been segmented and distributed across various channels. We have identified new trends and buzzwords such as "New Gray". This term refers to women in their 50s, 60s, and 70s who are expected to live up to 100 or 120 years. These women continue to aspire for youthfulness and beauty as they age. They have more disposable income than younger people and desire to look youthful. We actively market Chosungah TM to this demographic.

For Generation Z, we have a brand called Chocho’s LAB which can be found in more than 1000 Daiso stores in Korea. We believe beauty should be accessible to everyone, and the barrier to entry should not be high. There are people who want to wear makeup and look beautiful but find it too expensive or believe they don't have enough money. That's why we entered Daiso where people can access without worrying about the price. We aim to promote the idea of positive beauty. Everyone should have the opportunity and the right to be beautiful. Thus, Chosungah is running a campaign with a brand called CHOCHO’s LAB, which offers high-quality products at affordable prices, enabling everyone to experience beauty.

As such, our packaging is quite simple. It gives the impression of a product fresh from a lab, signifying that we don't invest heavily in packaging. Being affordable doesn't mean the quality should be compromised. Packaging can be costly. By minimizing packaging costs and maintaining product quality, we are campaigning for universal beauty. That is the essence of CHOCHO’s LAB, a brand championed by Chosungah, and the reason we are partnering with Daiso.

This approach ties into our brand philosophy. Having been in the makeup industry for a long time, I've observed that even beautiful actresses can lack confidence. The act of applying makeup can be stressful. They worry about looking unattractive, being unpopular, and experiencing emotional hurt. From meeting many women who have had these experiences, I've realized the importance of confidence. Makeup should not lead to a lack of confidence or make people give up. If someone with a decent level of self-esteem receives compliments such as "Your skin looks good," "You look young," or "Your lips are pretty," their mood lifts, they perform better at work, and even their love life improves. This is a fundamental truth.

That's why we've infused 30 years of artist expertise into our products as a form of technology. When children are left at a playground, they don't look for their mom; they just play. When they are left at a toy store like Toys "R" Us, they don't look for their mom; they just play. My vision is to create a similar playground for people regardless of their gender and age in the realm of beauty. To create products that can be applied easily and quickly for the better look. And when they look in the mirror, they should think, "I look good today." That is our brand philosophy.

So, we are creating a beauty playground for women and men. We are laying the foundation for effortless beauty where people can find their beauty in daily life. Through this beauty, one's self-esteem can easily be elevated. This is our campaign. We are segmenting it by age, needs, and distribution. Whether you're a makeup beginner or don't have a lot of money, everyone has the right to be beautiful.

If the process is too complex, people give up. There are too many steps, and even watching YouTube tutorials can be exhausting. You have to follow 10 steps. So, everything should be simple and easy. And there should be an element of fun that encourages you to do it yourself. We hold the same motto and slightly optimize it for each channel.

Taking my mother as an example, who is in her early 60s, she is truly beautiful. However, as she gets older, she has started to limit her use of makeup. She often contemplates whether she should spend money on L'Oreal or other French brands. What I understand from her and her generation is that they tend to stick to well-established French brands or brands they are familiar with, due to the different influences they have had compared to the younger generation. So, could you give some advice? What product from your brand would you recommend to my mother?

People over the age of 60 may find it difficult to apply multiple layers of makeup like younger individuals do. That's why Chosungah TM is popular on home shopping networks; its main target audience is people in their 50s and 60s. These are people who might find applying makeup to be a tedious task. It can feel awkward to apply makeup sporadically, such as when they go out. Therefore, daily makeup becomes incredibly important. Especially for those in the "gray zone", the simple act of applying a volumizing cream can result in a radiant, healthy-looking complexion. If a mother's neighbor comments, "Why does your face look so good today?", she will be motivated to apply it again the next day. This is the essence of the Chosungah brand. It's about motivation. It's about seeing yourself improve day by day, which encourages you to diligently apply the product. This leads to slow aging. It's all about motivation..

This is indeed a more personal question, but it's interesting nonetheless. Given your unique and vibrant personality, along with the fascinating history of your brand, I'm curious about your journey. You've transitioned from being a makeup artist to establishing a successful company. Looking far into the future, there will eventually come a time when you might retire or pass the reins of the company to the next generation. As the president and representative of CS Kosme, do you have an ultimate goal or dream that you aspire to accomplish during your tenure as a leader of CHOSUNGAH BEAUTY?

In the past, the Korean concept of 'quickly, quickly' was often negatively caricatured. However, I see the success that has been created by this 'quickly, quickly' as the engine of positive beauty.

Instead of dwelling on the negatives and suffering from low self-esteem, I believe it's essential to focus on the positives and even turn the negatives into positives. For me, beauty is not just about the outward appearance, but it also comes from within. Inner beauty is crucial, and it leads to a positive mindset about beauty. This mindset can transform the everyday life of a person, eventually leading to powerful branding campaigns.

Whether it's Korean artists who have been doing makeup for a long time, actors, ordinary people, or even people with disabilities, I've seen their happiness when they find a solution through makeup. I created my brand based on these successful experiences.

As an artist, there's a limit to how many people I can do makeup for in a day. I can't do it for more than 100 people, not even 30. Through my brand, I want to provide a fun and happy motivation for each day. I want to run campaigns that allow people to start their day joyfully, embracing and loving their appearance. The brand caters to a wide range of customers, from budget-friendly to high-end. My dream is to build a platform that reflects my philosophy. If a brand like this existed in Korea, and if its philosophy was reflected in its future vision, I would be extremely happy.

Even if I retire, I want to try to create this platform. There are many celebrities and ordinary people in Korea, and even women working in various markets, like those selling food in Dongdaemoon, who I want to transform. I envision a platform where they can become queens, where they can easily gain confidence, and think, "I can become like that, too." This is my dream, and this is what positive beauty is all about.

For more details, explore their website at http://www.csacosmic.com/

0 COMMENTS