The interview highlights the growing foreign investment in Japanese real estate, driven by factors such as stable interest rates and post-pandemic economic recovery. It delves into various sectors like tourism, housing, and offices, discussing their resilience and potential for growth. Additionally, it explores Mori Trust's role in developing high-end tourism, diversifying its overseas operations, and seizing investment opportunities, particularly in the US market.

Attracted by the yen’s devaluation, total foreign investments in Japanese real estate saw a 45% uptick in the first half of 2023 (CBRE report). Supported by large purchases in the warehouse and logistic segment, Singapore became the first source of foreign investment, totaling almost $ 3 billion, followed by the US, Canada, and the UAE. Considering the current global macroeconomic environment, what makes Japan so attractive to foreign investors?

We believe that Japan’s real estate development will continue to attract foreign investors due to the continuous development and renewal of the real estate market, especially in Tokyo, even in the face of financial recessions such as the global financial crisis and unexpected circumstances such as COVID-19.

In addition, Japan has recovered to pre-pandemic levels of economic activity by 2023. One factor contributing to this is the stability of interest rates. Stable interest rates in Japan have helped keep the economy resilient and stable.

In the hotel and tourism sector, inbound spending has reached a record high of over 5 trillion yen, and the number of visitors has recovered to 80% of the 2019 levels, although the 2023 figure was only achieved for six months of without any restrictions on activity. If this situation continues and the exchange rate remains stable, the hotel and tourism sector will become an increasingly large market, and the value of hotels as real estate will increase.

In the housing sector, the prices rose even during the pandemic. One factor contributing to this was the large number of luxury housing projects targeted at foreign investors in time for the 2020 Tokyo Olympics. Foreign investors were unable to visit Japan due to the pandemic, and as a result, Japanese people purchased these high-end residences, leading to the gentrification of the urban housing market. Now that the pandemic is over and foreign investors can visit Japan again, housing prices, especially in urban areas, are expected to rise even further.

In the office sector, office vacancy rates increased during the pandemic due to the “no office” trend. However, with the end of the pandemic, Japan has seen a return to office space compared with other countries, and the vacancy rate has been on a downward trend since October 2023. The pandemic has led to a rethinking of what it means to have an office, and offices have been redefined from mere workplaces to creative spaces. In addition, there has been a return to office space, and occupancy rates for both new and existing buildings are gradually increasing.

Real estate developers have been constantly investing to make urban areas more attractive, inviting foreign investors to invest and leading to further investment, which they see as a virtuous cycle that makes Japan attractive.

Japan was the last country to open borders after COVID-19, leading many analysts to argue that the recovery of various segments has yet to reach full swing. This is particularly true for the tourism sector, whose revenue has yet to reach 2019 levels. Leveraging this opportunity and the lack of luxury hotels across the Japanese island compared to other countries, premium brands, such as Hilton and Marriot, have expanded their footprint. As a historical partner to high-end hotel brands, including Marriot, Hilton, and Conrad, what role will Mori Trust play in the development of Japan’s high-end tourism and hotel sector? Which new locations do you believe have the highest potential for high-end foreign-affiliated hotel brands?

You mentioned that foreign hotel brands such as Marriott and Hilton were able to expand their presence during the COVID-19 period. However, COVID-19 itself was not the driving force behind their hotel expansion, as construction projects usually require a considerable planning period. It would be more accurate to say that the developers continued to build during COVID-19, which made the opening possible.

Before discussing 5-star hotels in detail, it is important to note that there are relatively few international hotel brands in Japan. Recognizing the importance of having international brand hotels to attract inbound tourists, the local regions are actively trying to attract international hotel chains. International hotel chains, on the other hand, have concentrated their openings mainly in Tokyo, Osaka, and Kyoto over the past 20 years, but now, as tourist destinations become more diverse, there is a growing interest in establishing locations in regional areas. As a result, the needs of those seeking to open new hotels and those receiving such openings have been met, leading to an increase in the number of global hotels.

The J.W. Marriott Hotel Nara, which opened in 2020, is one such example. The former governor of Nara Prefecture recognized that to attract international conferences, a hotel of international standards would always be needed as a supporting facility. After more than 10 years of searching for a suitable partner, Mori Trust invited J.W. Marriott Hotel Nara to be the developer, and after the plan was announced, about 10 new hotels were built in the surrounding area. At the time, Nara was one of 47 prefectures in Japan with a relatively small number of hotels, but the success in attracting foreign hotels to the area was seen as an example of a catalyst for the development and opening of other hotels.

Despite these developments, however, the growth of global luxury hotels in Japan’s regional areas has been relatively modest. Most new hotel openings are in the 3- or 4-star category. This is because while every region is eager to have a luxury hotel, the local infrastructure and demand may not be up to the level of a luxury hotel. As a result, investment across the country is limited and has not been able to attract enough customers willing to pay for luxury accommodations.

I believe that Japanese tourism has failed to grow for more than 30 years since the bursting of the bubble economy because of a lack of investment in opening new accommodation facilities and renovating existing ones. The creation of world-class hotels in local regions will encourage foreign tourists to come to Japan and diversify the destinations of inbound tourists. Such development should be recognized as a contribution to regional tourism.

It is true that the office space, especially when you talk about Tokyo, has behaved uniquely. If you look at vacancy rates, they are higher than they have historically been, however, they are still very low when compared to major cities like San Francisco. Many people said two years ago that it is the end of the office as we know it, and that remote working would take over, however, this hasn’t happened. The modern office has become more modular and perhaps more flexible, but we haven’t seen these large disruptions that might cause offices to become obsolete. How do you envision the future of office spaces and office utilization?

It is undeniable that in the COVID-19 pandemic, there was speculation that traditional offices would become less common. However, from our perspective, we did not believe that offices would disappear completely but rather anticipated the possibility of changing usage patterns and confirming the approach to their use.

The key characteristics of attractive office space are that it is new, accessible, and large enough.

I believe that offices with these characteristics are attractive to companies of all sizes, and I have focused on providing such offices.

Even when the bubble burst about 30 years ago, new, convenient, and spacious was still important in office space.

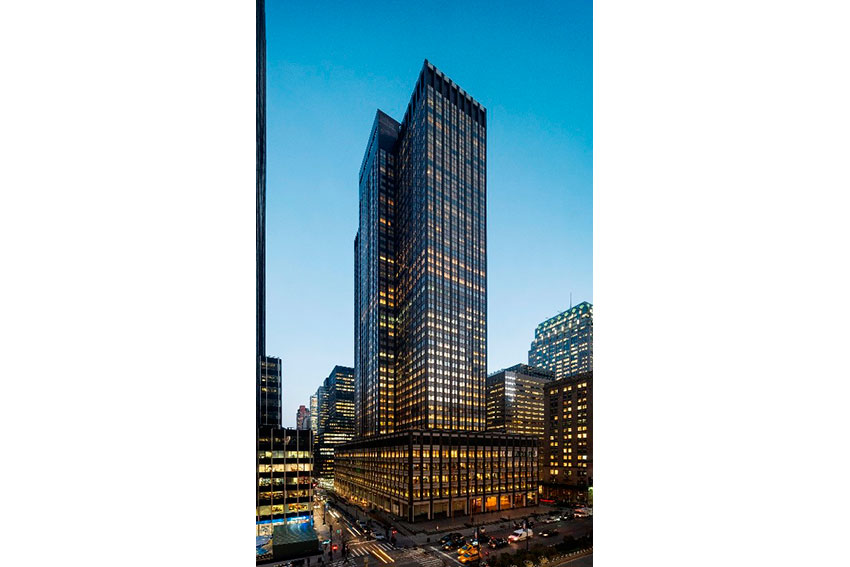

As a result, Japanese developers have consistently striven to create new buildings. Given this universal standard for office investment, we have been adding to our portfolio, most recently with a new investment at 245 Park Avenue in Manhattan, New York. Although the building is older, recent renovation trends in New York have encouraged our investment decisions, and the project is progressing well.

Remote working may improve work-life balance, but we question whether it fosters growth and creativity. Several studies have shown that there is a generational divide, with younger generations preferring office environments that encourage collaboration and professional development. The COVID-19 pandemic led to a re-assessment of the intrinsic value of working in an office environment, highlighting the need for people to seek a sense of purpose and community interaction. It also led to a re-assessment of office amenities in terms of comfort and functionality.

In May 2023, our company relocated its headquarters to create an office that would become a destination where employees naturally gather, combining the three elements that employees seek in an office: energy, synergy, and cozy. We believe that this need for a multifunctional office environment extends beyond our company. For this reason, we offer flexible office spaces designed to provide a work environment that is tailored to each employee’s needs.

Since 2016 and the start of Mori America you have invested mainly in offices in the US, but we are now starting to see some diversification. Last year you announced your investment into a laboratory and office complex located in Boston with a subsidiary of Alexandria Real Estate Equities which is famous for developing life sciences campuses. On top of that, you recently said in an interview that the company is willing and ready to invest JPY 1.2 trillion up to 2031 to diversify overseas operations. What do you mean by diversifying overseas operations? What regions are you looking at and what asset classes will you be looking to invest in?

Our management strategy is to diversify our portfolio to ensure stable operations. This strategy has proven particularly effective during difficult socio-economic times such as the COVID-19 pandemic. Recognizing that economic crises and natural disasters occur periodically, the Company prioritizes ensuring a stable cash flow for the resiliency of its real estate investments and continues to invest in growth while increasing its capital adequacy ratio, resulting in a long-term issuer credit rating of double-A-. To diversify the portfolio, we decided to focus on overseas markets in parallel with existing investments in Japan. When considering new regions for investment, priority will be given to those with stable currencies, legal frameworks, and political environments. In addition, we will look for regions with growing populations and strong industrial development initiatives.

In the hotel division, which has traditionally been viewed as a low-revenue investment, we have led efforts to transform our business model and increase the profitability and value of our hotel assets. Our strategy includes strategic investments in both cities and resorts to cater to a diverse tourist population, provide comprehensive services, and mitigate risk.

As we plan to invest a massive 1.2 trillion yen by FY2030, careful strategic planning and portfolio diversification remain paramount. By investing in line with market demand trends and carefully managing risk, we aim to optimize returns and ensure the long-term sustainability of our portfolio.

The purchase of the Park Avenue building came at a very good time. 2023 brought very tight credit conditions in the US and so there were few buyers on these large-scale projects. You were able to have the capital to complete this purchase during a downturn in the market when the building was essentially discounted. 2024 is set to be different, and experts expect the tightening cycle to stop. There are also expectations for the Federal Bank of America to start lowering interest rates in the second half of 2024 which should logically lead to a strong rebound in the US property market. If this does happen, how will it impact your US strategy? What do you have in mind for 2024?

Since 2016, we have been investing in real estate in the U.S. Initially, real estate prices were very high, and low cap rates made it difficult to invest. However, as interest rates began to rise, cap rates doubled, creating an opportunity for us to enter the market. For 245 Park Avenue, we believe our purchase could not have come at a better time. The property is not at its peak value at the time of purchase, but we expect it to be at its peak value when the office space is occupied after renovation, taking into account the return of office space in the U.S.

The real estate compound purchased in Park Avenue NYC

However, while we are excited about the potential of the property we purchased, 2023 was not a good year for Japanese companies to invest overseas due to the weak yen. In addition, the exchange rate has moved forward and although we currently have an unrealized gain, timing will determine whether or not our investment in 245 Park Avenue was successful.

Mori Trust is still a private company, which for the size of the company is very rare. In light of all of these recent investments, what advantages can you see from the private nature of the Mori Trust Group?

As a privately held company, we enjoy the freedom to make rational decisions without shareholder influence, and we can assess current trends and adopt flexible business strategies.

This autonomy allows us to quickly analyze data and proactively implement strategies without having to create and explain detailed business plans to external stakeholders.

However, unlike publicly traded companies, we recognize that as a business, trust is not easily earned.

For this reason, our company is conscious of maintaining a certain level of equity, i.e., a stable management base.

You have a successful track record when you look back at the past six years since you took over as president. What do you believe are the key reasons for your success? When you look to the future, what are some of your key personal targets that you wish to achieve?

The reason we have been able to promote various projects since I became president is that we have strategically diversified our portfolio. I joined Mori Trust in 1998, and for the first 10 years of my career, I was responsible for both office development and hotel management. Being involved in both divisions gave me the opportunity to find the affinity between them and improve both at the same time. This experience has given me a better understanding of the importance of portfolio diversification.

The medium-term goal by FY2030 is to make the office a major source of income and stable occupancy, to develop the hotel division that can generate as much income as the office, and to increase our presence in residential investments. Through careful planning, we have secured several promising sites for hotel development since 2016, and plans are being formulated for future development and operation.

Similarly, the residential business will be strategically developed and positioned for optimal growth and performance.

With our strategic vision and portfolio diversification, we will achieve our mid- to long-term vision of “Advance 2030” by FY2030.

For more details, explore their website at https://www.mori-trust.co.jp/english/

0 COMMENTS