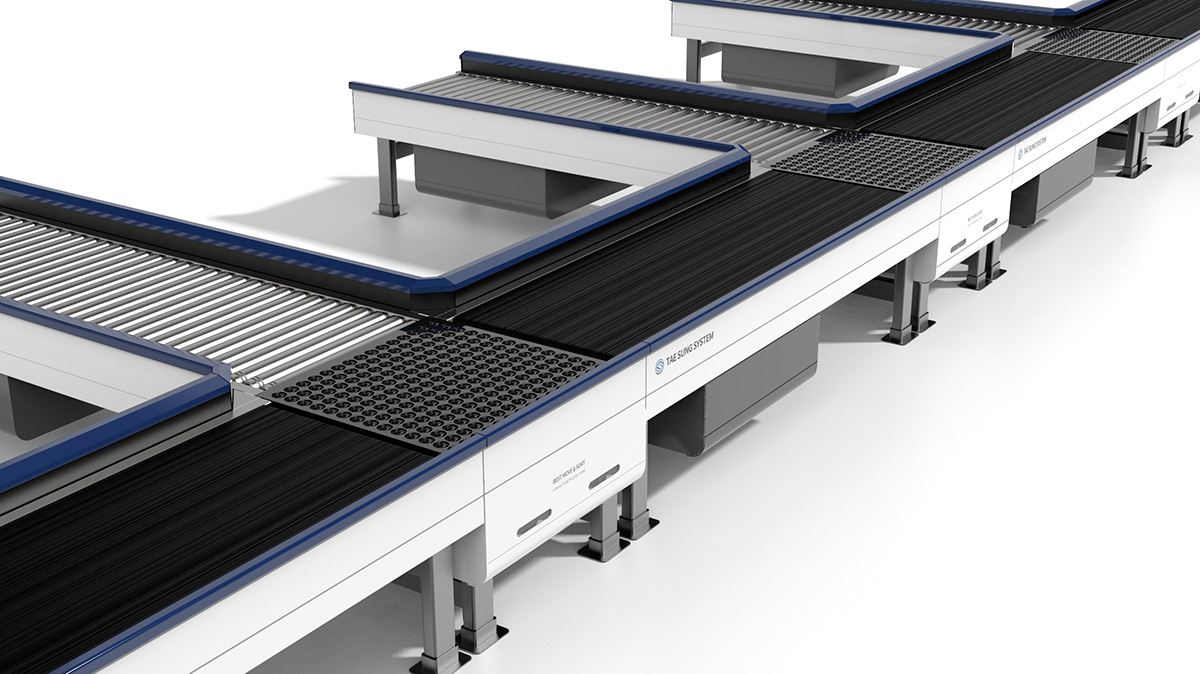

Since its establishment in 2016, TaeSung System Co., Ltd. has been on a trajectory of growth and recognition. The company's forte lies in innovative compact sorting solutions, meticulously tailored to meet the needs of clients in Korea and worldwide. Backed by a proficient team of automation engineers, TaeSung manages the entire process, from installation and production to on-site commissioning. Noteworthy is their acclaimed wheel sorter technology, lauded for its adeptness in efficiently and precisely sorting small items.

As my colleague noted in the initial part of this comprehensive presentation, Korean SMEs have made significant strides in developing and bolstering a self-reliant supply chain within Korea through collaboration with larger conglomerates like LG and Hyundai. The pressing question on everyone's minds now is, can these SMEs sustain their growth trajectory by venturing into international markets? Do they possess enough competitive edge to shift from their domestic sphere and genuinely contend in the global arena?

Addressing your question, it is key to remember that until the 1980s, the focus of Korean government policies was largely on supporting and growing conglomerates, making it challenging for Korean SMEs to enhance their global competitiveness or expand their market share. However, with a shift in administrations and the establishment of the Ministry of SMEs, we have witnessed the rise of unicorn companies nurtured by the Korean administration.

Although small, Korean SMEs have managed to stay competitive and hold their ground amidst adverse macroeconomic conditions. Our belief is that, despite our size, Korean SMEs possess the technological expertise and manufacturing capacity that can give us a competitive edge over global contenders. We have the potential to play a significant role in the global market, not just domestically, thanks to our favorable conditions, albeit the limitations tied to our size.

There are undoubtedly challenges we need to overcome, particularly in areas like marketing capacity and sales activity. However, we firmly believe it is only a matter of time. There is a great deal of pride among Korean SMEs, fostering confidence in our ability to grow globally.

Addressing your second question, while we might not match the scale of conglomerates like Samsung, Hyundai, or LG, our ability to concentrate on niche markets, which larger companies may lack the time or resources to focus on, sets us apart. This includes secondary industries like wheel sorter or vertical tilt tray sorter development, where conglomerates have struggled to penetrate.

Despite being in this industry for only seven years, our intensive research and development in these inaccessible niche markets has earned us considerable recognition. We consider ourselves an ideal candidate since we specialize in this niche market, exactly what you are seeking.

Contrary to conglomerates like Samsung or Hyundai, we have a distinct competitive advantage in this niche market, which has been key to our success over the last seven years. Our focused approach to research and development, concentrating on previously conglomerate-dominated markets, is our unique strength to expand our market share.

We have had numerous interactions with SMEs, and a common theme we have encountered when discussing their global potential is the perspective of their competitiveness. Many suggest that having worked in Korea, and having clients like Samsung, Hyundai, and LG - considered some of the most challenging clients to please globally - equips them well to satisfy any international company. Do you concur with this sentiment?

While I understand the viewpoint, I must respectfully disagree. I believe that SMEs globally must not only foster mutually beneficial partnerships with large conglomerates but also maintain competitiveness amongst each other. Thus, I perceive that we, as SMEs, must face and overcome specific challenges in the market, demanding our utmost dedication and effort.

The current market scenario, especially pertaining to manufacturing and the overall economy, seems quite complex. We have seen disruptions caused by government interventions, monetary policy shifts, inflation, geopolitical risks with China, and an increase in semiconductor inventory that has left the manufacturing sector somewhat unsteady.

However, over the past few months, large companies such as Samsung, Intel, ASML, and even Hyundai have projected that they expect the manufacturing sector to regain stability and recommence rapid growth by the second half of the year. Could you share your perspective on the evolution of the manufacturing sector over the next one to three years? Additionally, what implications do you see this having on the demand for logistics automation?

Addressing your question, while it may seem daunting for a CEO of a small-scale company like ours, I believe we are witnessing a new form of 'cold war' evolving between the liberal, democratic US, and the authoritarian regime in China. The dynamics appear to mirror the cold war between the Soviet Union and the US.

Discussing Korea specifically, our economy is currently more reliant on China, but I foresee a strategic shift towards the US. This necessitates competition with Chinese rivals. In this process, some Korean SMEs may unfortunately fall behind in the race. However, I also believe certain companies will be capable of seizing the opportunities that arise amidst this global tension.

The global logistics automation market is predicted to hit a $162 billion by 2030, reflecting a compound annual growth rate of 13.5% over the next eight years. In your view, what are the primary trends that will shape the evolution of the logistics automation sector?

It is crucial, I believe, to differentiate between the Korean market and international markets. As you are aware, Korea has a high population density within a relatively small landmass, which creates ample opportunities to diversify our logistics equipment, strategies, and systems. This is a significant factor behind the substantial investments made in the logistics sector over the past five years. I foresee a steady growth trajectory in logistics for the next decade.

As for the logistics ecosystem, the focus should be on identifying which sectors within logistics are poised for growth over the next few decades. For our company, we are specifically targeting the sortation equipment sector, which we predict will experience considerable growth in the coming years. We will discuss our internal strategy regarding this sector later.

In contrast, the dynamics of the overseas market differ. For instance, while Taesung, as a system integrator, handles the entire process from installation, production, demonstration, to site commissioning in the local market, in the overseas market, local entities would typically handle system integration for our equipment. Thus, the Korean and overseas markets present different operational contexts.

Let's delve deeper into understanding your company. As my colleague noted, you have various series ranging from wheel sorting to pivoting. Also, your brochure indicates a strategic diversification into AMR to become a comprehensive solution provider for logistic automation. Before we delve into those specifics, could you provide us with a brief overview of the company's inception and its growth journey to the present day?

Since our establishment in 2016, we have experienced a progression of growth and recognition in the market. We initially developed a control system, which subsequently led us to design and export the wheel sorter to Southeast Asian countries. This achievement drew attention, enabling us to secure orders from major conglomerates within Korea. From 2020 onwards, we launched the FULFILIO (Vertical Tilt Tray Sorter), supplying these to our large-scale clients.

Our success does not merely lie in the development of these systems, but more crucially, in our distinct competitive advantage over domestic competitors. This edge allowed us to pioneer into fresh markets, contributing to our swift growth, as opposed to simply trailing in the wake of domestic companies producing similar equipment. Our wheel sorter is particularly lauded for its ability to sort out small items effectively and with high quality.

As I mentioned earlier, our triumph rests in blazing a trail into niche markets that conglomerates found challenging to reach. Starting from the control system, we developed equipment capable of sorting even the smallest item - a 55-millimeter pitch, which many conglomerates had not considered viable. Such innovations gained the recognition of conglomerates, allowing us to supply equipment to large clients on an exclusive basis.

Our strategy differentiates us from similarly sized companies in Korea. We refuse to settle with our current domestic market share or revenue. Instead, we strive to gain a foothold in the global market and aim to become a top player. Over the past two to three years, we have worked to establish a presence in Europe, which has culminated in the successful establishment of Taesung Europe. We are also collaborating with a US-based company, further expanding our business footprint.

Three years ago, our primary clients were based in Southeast Asia. Now, we have expanded into Europe and export our equipment to Norway, Turkey, France, the UK, and even South Africa. We are also setting our sights on the American market. This geographical expansion is a testament to the global appeal of Taesung's equipment. We aim for an even more aggressive global expansion in the future.

What do you believe are the unique competitive advantages that your company offers to your international clients?

Our successful global expansion into Southeast Asia largely stemmed from the recognition of our equipment's competitiveness by local system integrators. Our reputation essentially spread via word-of-mouth, eliminating the need for us to extensively showcase our equipment.

Drawing parallels with the experience in Southeast Asia, I believe we can affirm our competitiveness in European or American markets as well. The process involves local system integrators testing and demonstrating our equipment. Through this, they can confirm the high quality and reliability of our products - being virtually error-free and smoothly operational. This testing and validation process, similar to what occurred in Southeast Asia, is the approach we are keen to replicate in expanding our footprint in global markets.

So, if I am understanding correctly, is your strategy for expansion centered around collaborating with system integrators already established in Europe and the US, who are now testing your products to assess their reliability?

Absolutely, you have understood it correctly. Our initial plan indeed involves partnering with European system integrators. Subsequently, as our business progresses and yields success, we contemplate the possibility of establishing our own manufacturing facility in the region.

Newsweek has a broad readership in both the US and Europe. So, I am curious, if you had the chance to share a success story with your system integrators - a story about a client who requested something seemingly impossible or extraordinary, yet you managed to deliver - which story would you choose to share with them?

While no particular requests have been exceptionally challenging, the true hurdle is often convincing our end clients to trust our Korean-made equipment as they import these foreign-made products. It is important for them to experience the quality of our equipment firsthand.

Several factors come into play here, including service cost, delivery time, and particularly maintenance when it comes to importing equipment from overseas. While elements such as Just In Time (JIT) or certain conditions may be negotiable with clients, maintenance is an area where we, as an overseas contractor, admittedly have a weak spot.

Hence, our focus is on minimizing the need for maintenance for our clients. Naturally, any equipment or machines can encounter issues, so we are trying to reduce these potential hassles for our clients. We do this by providing necessary spare parts and crafting our design to be more competitive than our rivals. This way, our clients can replace parts whenever and wherever necessary.

We have discussed extensively about the compact sorting solution. Now, I would like to shift our focus to the smart factory solution and the development of Autonomous Mobile Robots (AMRs) that I understand you are beginning to mass produce for clients, including LG Innotech. Could you shed some light on your AMRs, the smart factory solution, and how these elements synergize with your compact sorting solutions?

From our perspective, we are certain that the growth of the logistics market will extend beyond mere hardware to also encompass IT systems. As technologies like AI, chatbots, and other sophisticated IT systems evolve, there will be inevitable limitations if we focus solely on machinery or equipment. To address this, we have developed certain solutions. However, it is still in the development stage, so it is difficult to tell you the details right now.

A year ago, we acquired companies specializing in Autonomous Mobile Robots (AMRs) or Automated Guided Vehicles (AGVs). The process of merging and integrating these companies is currently ongoing. While we indeed have solutions ready, it is a bit too soon to reveal them in depth. Our goal extends beyond merely connecting equipment; we aim to integrate all these machines and devices to generate novel value and experiences for our clients. We are striving to introduce innovative solutions in the near future.

Indeed, the recent acquisitions in the field of robotics have us excited for the future. New technologies are indeed reshaping the landscape of logistics automation, with advancements in 3D scanning, Augmented Reality (AR), and various types of parcel sortation playing pivotal roles. With this in mind, where do you envision your company in the next five years? How do you foresee your product offerings evolving, and what geographic markets do you plan to tap into?

Although we might not be on the same scale as conglomerates like Samsung, Hyundai, LG or POSCO, and our revenue in logistics may not match theirs at the moment, I can confidently assert that we are the leading provider of solutions in the local Korean market. This is evident in the high regard and recognition we receive from the industry.

When it comes to overseas markets, our focus is on gaining recognition for the superior quality of our equipment in the European and American markets.

We view our role as encompassing a large portion of the entire logistics process. Therefore, in terms of sorting and control, our strategic plan involves establishing a separate entity that can secure a commanding position in the market as we move forward.

Reflecting on the past seven years since the inception of your company in 2016, could you share with us the achievement you are most proud of? Furthermore, is there something you look back on and wish you had approached differently?

I should clarify that I only took the helm of the company three years ago; the former CEO founded it seven years back. Therefore, I may not be able to reflect on the entire seven-year journey.

The company, Taesung, has gained recognition for its specialized technology, with our clients highly appreciating our work. This client appreciation has become a form of organic marketing, effectively making our clients our ambassadors.

My duty as CEO is to maintain and enhance the prosperity of this company, ensuring continued client satisfaction, and in that respect, I am currently very content.

I would like to share a recent success story. It involved winning a bidding process for a large conglomerate. Despite other competitors, we secured the contract. Though our costs were evaluated as higher than others, the final judgment was based on our comprehensive system and its ability to solve the customer's pain points. The assessment acknowledged that Taesung was the optimal choice, as we had effectively tailored our equipment to meet the client's needs.

0 COMMENTS