The transcript highlights the evolution and challenges of Japan's regulatory system for regenerative medicine, focusing on the experiences of J-TEC, a company specializing in autologous regenerative medical products. Initially facing hurdles due to no regulations, the introduction of the PMD Act and the categorization of regenerative medical products facilitated smoother processes. Japan's flexible framework and emphasis on evidence accumulation have attracted foreign biotech companies.

One of the big criticisms of the Japanese medical sector has been its slow regulatory processes. On average it is about 3-5 years slower than that of Europe and the US. However, we have seen some changes in recent times. The introduction of the Sakigake system and the PMD Act come to mind. From your point of view, how would you rate Japan’s regulatory system today, and what are some of the improvements you would like to see?

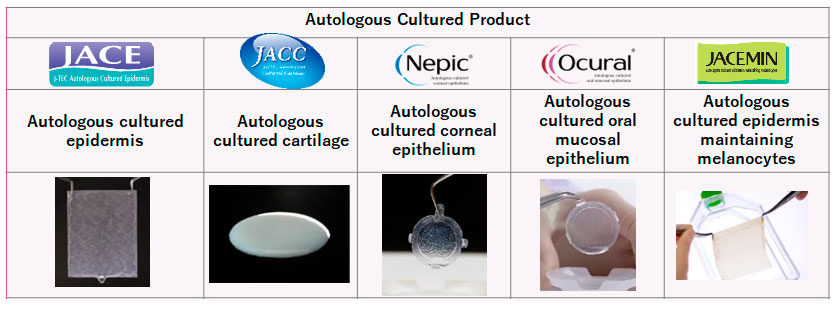

When we started our business in 1999, the regulatory process was different from the current system. The regulatory process back then was only for pharmaceuticals and medical devices, and not suitable for regenerative medicine. Our regenerative medical products are autologous (using patient’s own cells), and no such business of providing patient’s cells as a product existed in Japan before. Thus, everything was a challenge, for companies as well as for the authorities. It took 10 years for our autologous cultured epidermis JACE (launched in 2009) and 13 years for our autologous cultured cartilage JACC (launched in 2013) to obtain marketing approval and receive insurance coverage.

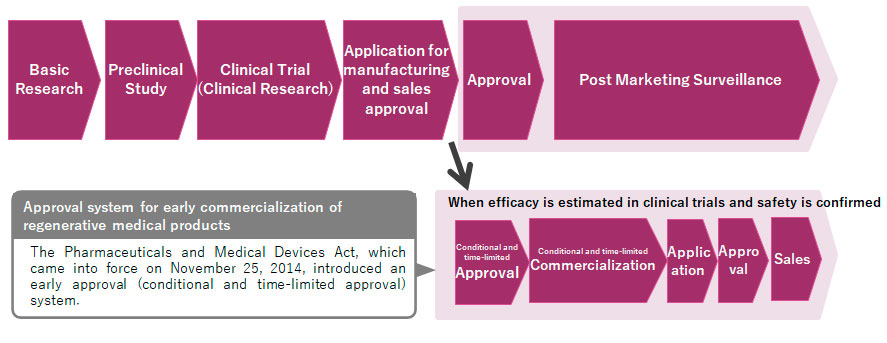

However, in 2014, the former Pharmaceutical Affairs Act was replaced by the Pharmaceuticals and Medical Devices (PMD) Act, and the new category of "regenerative medical products" was added to the existing categories of pharmaceuticals and medical devices. This categoric change was important for our company as many discussions began and things became smoother. I believe we were given more opportunities to talk openly with the authorities.

The regulatory changes that occurred led to more innovative ideas/seeds being realized, and the environment for regenerative medicine changed. As of March 2024, there are 20 regenerative medical products approved in Japan, 5 of which are J-TEC products. Technologies are progressing every day in the world, and Japan must compete in the global market. This has led to the authorities changing their mindset and encouraging more companies and enterprises to become more involved in this field.

J-TEC’s regenerative medical products

If we look at the field of regenerative medicine, Japan has created one of the most flexible frameworks for development. As such, we have seen that there are a lot of foreign biotech companies coming to Japan and conducting clinical trials here. Why do you think foreign biotech and regenerative medicine companies are interested in setting up in Japan? What are the advantages of doing that in Japan rather than in Europe or the US?

As I mentioned earlier, Japan’s regulatory system has changed and the environment is becoming more suitable for obtaining marketing approval for regenerative medical products. It is also true that major overseas pharmaceutical companies have begun to obtain approval to manufacture and sell regenerative medical products in Japan. In this regard, the Japanese market itself is not necessarily small, and as the government bears the treatment cost through national health insurance, more patients can have access to regenerative medicine.

However, on the other hand, Japan's progressive initiatives in regulations are not yet recognized overseas, and I consider it extremely important to properly communicate these details of Japan’s initiatives to the world. Certainly, there are language issues, and Japan's unique frameworks may also have an influence. Additionally, in CDMOs, Japanese partners may be needed. Japan's PMDA actively takes the initiative in disseminating information overseas by writing English papers. J-TEC is working with the Teijin Group to meet this demand for CDMOs. I believe it is imperative to firmly maintain the development environment in Japan and to spread this information appropriately.

With this background, I would like to discuss the benefits for foreign companies to set up in Japan.

Historically, products of alternatives to transplantation medicine, which I mentioned earlier, have been pioneered as regenerative medicine in Japan. The use of cells is different from pharmaceuticals, and the characteristics of the products are extremely diverse and also influenced by the technique of the surgeon. In other words, the business model of conventional pharmaceuticals is often not applicable. Japan's regulatory authorities have abundant experience with this transplant-type regenerative medicine, and accumulated expertise in properly evaluating and reviewing regenerative medical products.

Perhaps, Japan provides a relatively easy-to-implement environment for creating such products for transplant-type regenerative medicine.

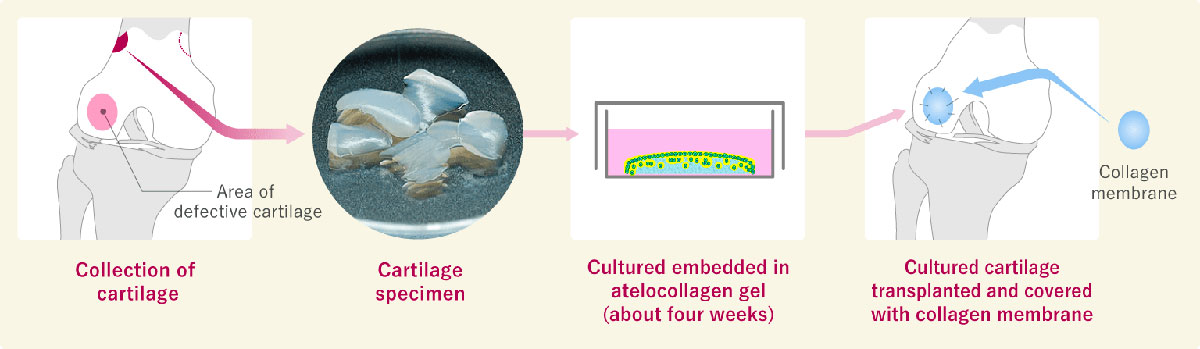

Regulatory system in Japan

Let me show you an example that is a little easier to understand. From our experience, regenerative medical products using autologous (patient’s own) cells are not suited to mass production. They are ultimately custom-made products. Doctors take a small tissue biopsy from a patient, and the tissue is delivered to J-TEC, we culture the cells and package them, then we deliver the autologous cell product to the hospital for transplantation. We focused on providing a stable supply of products and we have provided to over 2,500 patients. We have been dealing with issues like how to provide small-lot products, how to control the quality of patient cells that vary, how to reduce costs, and how to manage a variety of raw materials, etc. Furthermore, since the product is provided to patients through transplant surgery, it is greatly influenced by the techniques of the surgeon. Companies have the responsibility to provide appropriate and latest information for surgeons. Creating a new business model is to face and overcome these challenges with speed. I believe Japan's strength lies in the continuation of these efforts, including the experience of regulatory authorities.

Business model for autologous regenerative medical product

Transplantation of autologous cultured cartilage (knee joint)

In my opinion, tissue transplantation in Japan is quite different from how it is done overseas. Japan's regenerative medicine, especially the treatment using patient cells like autologous cultured cartilage, is evolving ahead of the rest of the world, and I believe it could become a world-class medical treatment. Not only patients in Japan but also patients around the world can benefit from it.

It is interesting to hear you describe the different business models. The field of regenerative medicine had a lot of promise 10 years ago. It was said that it would revolutionize medicine. However, progress has been slow. Various studies in the field of regenerative medicine have been conducted, but its social implementation is difficult and that is where many companies fail. Why do you think that was the case, and why has your business model been successful?

J-TEC possesses all functions from research and development, regulatory affairs, manufacturing, sales, and post-marketing support because no one provided these services when we started this business. By having the entire value chain in-house, we were able to develop a completely new business model on our own, overcoming the unique difficulties of regenerative medical products. Furthermore, we have established a cycle of “reverse translational research” utilizing post-marketing clinical results and feeding back into the development of the next product. It is also our strong point that we have the experience and human resources to carry it out.

However, I cannot say our business model has been a success thus far, as our financial foundation is not yet solid. There are still many challenges to be overcome for the implementation of regenerative medicine into society. As a manufacturer, we need to optimize our hardware along with human resource development, improving production efficiency and reducing costs through mechanization and automation. We still have much to do to make our business sustainable.

You just explained that for this model to work, it requires the creation of a new business model. There is a need to educate the patients about these novel techniques. There is also a need to educate companies and hospitals. We know that hospitals and medical institutions are especially conservative and it can be difficult to change their mindsets. How do you educate these stakeholders to penetrate your new business model?

Providing doctors and hospitals with our product information for proper use is essential. At the same time, cooperation with them is also important. In regenerative medicine, the accumulation of evidence is vital. J-TEC sales representatives are closely communicating with doctors, collecting and providing information, solving problems, and working together to develop optimal treatment methods. For transplant-type regenerative medicine, close collaboration with doctors and medical institutions is mandatory.

As an example of mutual collaboration, in order to confirm the effectiveness and safety of our cultured cartilage JACC, we conducted a post-marketing surveillance covering all cases over seven years. As a result of a re-examination based on real-world data, the Ministry of Health, Labour, and Welfare reconfirmed the efficacy and safety of JACC in June 2022. This couldn’t be achieved without the cooperation of doctors. It takes time and continuous effort to implement regenerative medicine into society, and we have been working together with many stakeholders.

In addition to medicine, we know that you take pride in and encourage the implementation of research using cultured human tissues in a wide array of locations. Cosmetic development and drugs for external use come to mind. To support your R&D practices, you have developed LabCyte for research use which is produced by cultured human cells in vitro. You have two variations, the EPI-Model, and the Cornea-Model. How does your LabCyte elevate and improve your customers’ R&D, and what are the specific target applications you are focusing on?

We started our R&D support business in 2005, utilizing our high-level tissue culture technology to promote the development of a diverse range of cultured human tissues for research use. As there is a worldwide trend that animal experiments are being banned, demand for tissue models is rapidly increasing. We have two types of products; cultured human epidermis EPI-MODEL and cultured human corneal epithelium CORNEA-MODEL. Tissue models manufactured by culturing human cells in vitro can be used to replace animal testing, and EPI-MODEL24 is listed in OECD test guidelines (in vitro skin irritation test TG439 & in vitro skin corrosion test TG431). CORNEA-MODEL24 is listed in the OECD test guideline (in vitro eye irritation test TG492) as well. Furthermore, Kao Corporation, a major Japanese cosmetics manufacturer, is developing a new in vitro skin sensitization test “EpiSensA” using EPI-MODEL24. Currently, we manufacture and sell the LabCyte series mainly in the domestic market, however, market research shows that Asia especially India and China will grow, and we are planning to expand the business overseas.

We know that in March 2021, your firm became a member of the Teijin Group after transferring from Fujifilm. What was the reason for the switch between parent companies, and what synergies are you able to leverage as part of the Teijin Group?

Materials, overseas business networks, strengthening financial foundations, etc. are some of the advantages and benefits for us of working under the Teijin Group. Teijin is the pioneer who produced the idea of medicine that is done at home, so their mindset and experience are helpful for us. They have materials that we do not have, such as bioresorbable materials, and they also provide implantable medical devices such as knee replacement products. We can demonstrate synergy in the orthopedic field.

Moreover, Teijin has a strong interest in contract development and manufacturing organization (CDMO) business in regenerative medicine. In September 2022, together with Teijin, National Cancer Center (NCC), and Mitsui Fudosan, J-TEC established a regenerative medicine platform in Kashiwanoha Smart City, a life science business park in Kashiwa City, Chiba Prefecture, Japan. The platform supports the development of innovative treatments for diseases with unmet medical needs such as cancer. It serves as a one-stop system supporting research and development, business plan formulation, and commercial production of regenerative medical products. We are working to create a system that will quickly implement innovative technologies (e.g. cancer treatments such as CAR-T) possessed by domestic and foreign companies and academia into society.

Additionally, Teijin has a vast network in the global market. As J-TEC is still a small company, Teijin’s global network will be particularly important to us upon expansion abroad. In April 2023, utilizing Teijin’s global networks, we formed a business alliance with Resilience US, Inc. to enhance CDMO capabilities for cell and gene therapies, including regenerative medicines, to customers in North America and Asia-Pacific (APAC).

When it comes to the international aspect of your business, what regions around the world do you believe have the most potential for your firm?

When you consider our business model, it is not a simple import and export business. We must bring our system overseas to the particular country or hospital with which we are dealing. Therefore, we need to focus on places that are close to Japan geographically. The Asian market is quite attractive for us when expanding abroad.

On the contrary, some patients may come to Japan from overseas. For example, medical tourism is quite popular for people in countries such as Thailand and Singapore. If there are treatments using regenerative medicine that can only be received in Japan, and if they are excellent and attractive, such an approach by bringing overseas markets into Japan can be a viable strategy. To maximize the value of regenerative medicine, we would like to build an optimal ecosystem first in Japan and spread Japan's advanced technology out to the world.

Please imagine that we return to interview you again in 5 years. What ambitions or objectives would you like to have achieved for J-TEC that you would like to tell us about in that second interview?

My goal for the next 5 years is to make our regenerative medicine technologies more widespread, not only in the domestic market but also in the overseas market as well. As our fifth regenerative medical product, we are now developing autologous cultured epidermis maintaining melanocytes JACEMIN for the treatment of vitiligo. We are currently waiting for this product to be covered by national health insurance. Once covered, we can offer a new treatment option for more patients. Also, we are now conducting a clinical trial to expand the indication of our autologous cultured cartilage JACC to knee osteoarthritis (OA). We have already carried out treatment and follow-up observation of all cases, and the clinical results showed a significant improvement. We will continue to work towards making autologous cultured cartilage an option for more patients, including patients with knee osteoarthritis. In addition, the development of allogeneic cultured epidermis Allo-JaCE03, Japan's first ready-made product (which can be manufactured and stored in advance and used when needed without delay) made from allogeneic skin tissue, is underway. This product can also broaden our market, domestic and foreign, and become a new treatment option for a vast number of patients.

Our vision is “Creating a Future for Regenerative Medicine.” We have accumulated experience in creating and supplying products made from patients' cells. In the not-too-distant future, we want to offer our experience to even more patients. We want to use regenerative medical products to cure all kinds of injuries and diseases, not just in the fields of epidermis, cartilage, and cornea. Someday, regenerative medicine will be a standard healthcare. We continue to strive in all kinds of fields to create a reality in which everyone can enjoy the benefits of regenerative medicine.

For more details, explore their website at https://www.jpte.co.jp/en/

Interview conducted by Karune Walker & Antoine Azoulay

0 COMMENTS